Flagstar Bank earns below-average feedback for the J

Inspire grounds

D. Energy 2020 You.S. Primary Home loan Servicer Pleasure Data together with J.D. Electricity 2019 U.S. Number one Home loan Origination Fulfillment Data. In reality, Flagstar has experienced a reputation less than-mediocre marks during these degree for the past very long time, which have client satisfaction for origination with good poorer appearing than just consumer fulfillment to own repair. It is value listing, but not, that Flagstar Lender provides gained an a+ regarding the Better business bureau — and that claims that when people perform complain, the lending company reaches out and will pick a resolution.

Nationwide HELOC choice

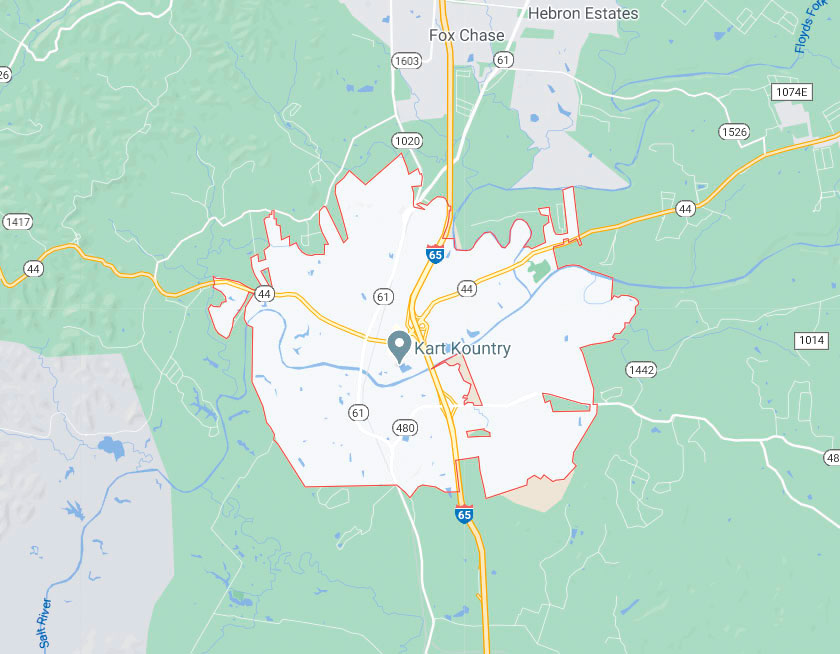

If you are considering a home collateral credit line (HELOC), you really should look somewhere else. An excellent HELOC is only open to consumers in a really brief number of zip rules. Flagstar does not give domestic collateral money in all cities where it’s got an actual exposure.

Choice to look at

Guild Financial. If you’re looking to have downpayment assistance, check with Guild Financial. Guild is fantastic for first-day home buyers. It lender also offers low down percentage mortgage loans and you can programs for people who are in need of assist getting into homeownership. Guild Mortgage also offers a good 17-date closure make sure, that will be ideal for customers who want a simple loan closing.

SunTrust Home loan. If you prefer a specialized mortgage, view SunTrust to have analysis. Instance Flagstar, SunTrust try an entire-service financial institution that offers bank accounts including mortgages. In addition, it features a full diet plan away from financial solutions, in addition to HELOCs.

Our very own product reviews are based on a 5 star level. 5 celebrities means Top. 4 superstars translates to Advanced level. step three celebs translates to A. dos famous people equals Fair. 1 star translates to Worst. We want your bank account to be effective more difficult for your requirements. Which is why the critiques is biased towards now offers one to submit versatility whenever you are eliminating-of-pocket can cost you. = Better = Excellent = A good = Reasonable = Bad

Our very own reviews depend on a 5 star size. 5 celebrities means Finest. 4 famous people means Higher level. 3 famous people translates to A beneficial. dos celebrities equals Reasonable. 1 superstar equals Worst. We want your finances to be effective much harder to you personally. For this reason , all of our critiques is actually biased for the offers one to send liberty whenever you https://cashadvancecompass.com/loans/loans-for-veterans/ are eliminating-of-wallet will cost you. = Most readily useful = Advanced level = A great = Fair = Bad

- 0% – 3.5%

- 0% – step 3.5%

Minium Advance payment 0% for USDA financing and you will Virtual assistant finance step three.5% for Va funds (minimal 580 credit score) 3% to possess conventional funds

- 540 (FHA)

- 620 (Conventional)

- 580 – 620

Simple tips to qualify

Having an enthusiastic FHA mortgage, licensed consumers you need an excellent FICO Rating with a minimum of 580. But if you require a traditional mortgage, the minimum was 620. To own good jumbo financing to $step 3 million, you prefer a beneficial 700 or higher.

The debt-to-income proportion (DTI) is short for is the total monthly debt percentage, including your mortgage repayment, compared to the your income. A mortgage lender would like to definitely can afford to settle the borrowed funds, so that they look at the simply how much you have to spend monthly. They will certainly tally right up all your required lowest costs to find from the monthly payment number that one can afford to have houses. All those money along with her compensate their DTI. Flagstar Lender home loan allows a beneficial DTI doing fifty% (of one’s pretax income) to own old-fashioned fund, but merely 43% to own a good jumbo mortgage. Particular FHA finance ensure it is a great DTI between these numbers.

It’s a good idea playing your existing expense before you could get home financing, while the quicker personal debt setting you could be eligible for increased monthly mortgage payment. Qualifying to own a more impressive commission you are going to lay way more (or nicer) residential property on your to-come across list.